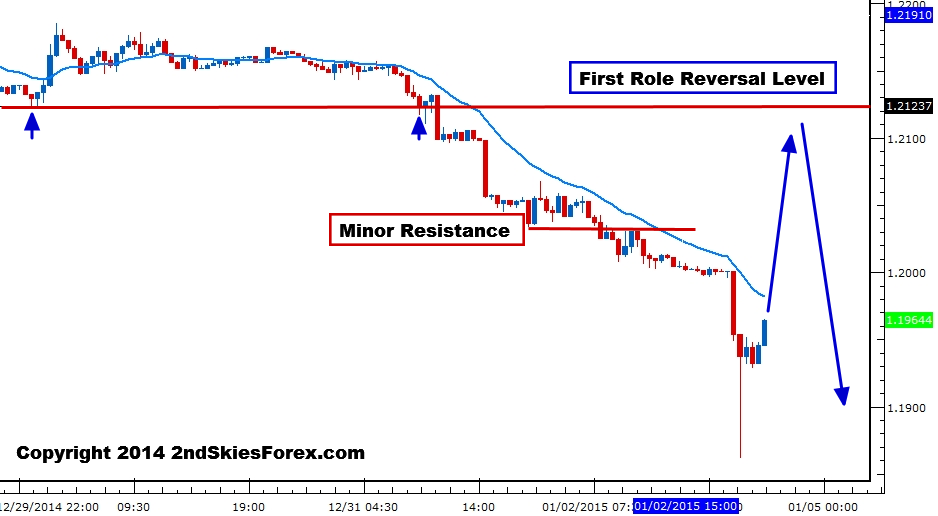

EURUSD – Bounce Expected, But Looking to Sell (30m Chart)

After dropping about 100 pips from the open, the Euro is bouncing off of major long term support around 1.1860/75. This key support level has held since 2006 and was last tested back in June 2010 where it produced a significant bounce up to 1.5000.

Although I’m expecting some shorts to cover and some solid profit taking, I’m still expecting another leg lower and rallies to be sold. The first major role reversal level comes in around 1.2123, so am looking to sell on rallies into resistance. 1.2042 might offer some potential resistance being a former major support from 2012 which led to the last bounce to 1.40.

Downside targets are 1.1860/75 and then 1.1650. Only a daily close above 1.2250 changes our ST & MT bearish bias.

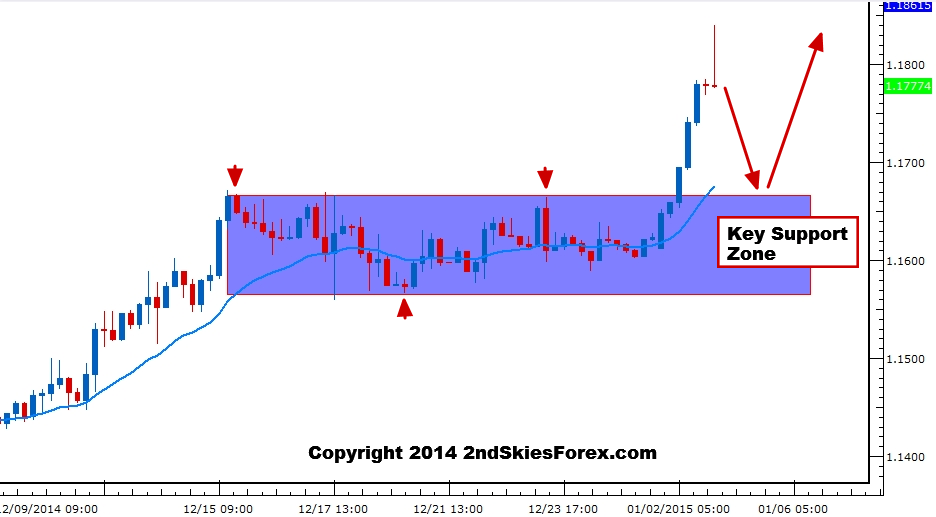

USDCAD – Looking to Buy on Pullbacks to Support Zone (4hr chart)

After breaking out and above the key consolidation and corrective zone we’ve talked about in prior commentaries, the pair has hit the resistance level we mentioned around 1.1850.

I’m expecting any pullbacks into this area to be bought as its a pretty thick support zone to buy from. Hence I’ll look to buy in this support zone, and target 1.1845, and then 1.1990 just ahead of the big figure at 1.20.

Only a daily close below 1.1550 takes away the bullish price action bias.

Also in our members trade setups commentary, we cover the GBPUSD, NZDUSD & WTI.